A sole traders are the most straightforward form of business designed for individuals. It is defined as “an unincorporated business owned & operated by one person who pays personal income tax on profits and is personally liable for the business debts.” In this framework, the proprietor assumes complete ownership of the business entity, bearing all associated risks and obligations while retaining full authority over decision-making processes.

Being your boss and running your own business might seem interesting and lucrative, but it involves considerable financial management responsibility. Hence, assistance from professional accountants for sole traders becomes necessary.

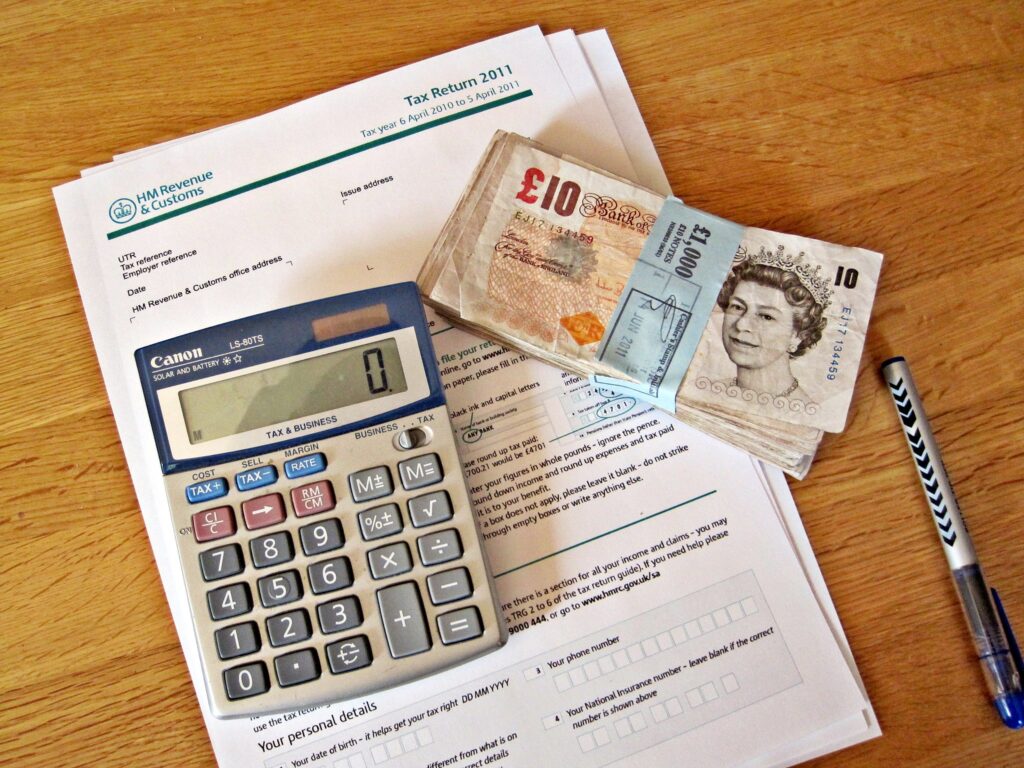

This guide will help you learn about sole trader business, including who is a sole trader, initial setup, and sole trader tax & accounting. So, if you plan to establish yourself as a sole trader, this guide is exactly what you need.

Who is a Sole Trader?

A sole trader, or sole proprietor, denotes an individual who operates a business independently without establishing a distinct legal entity. In this structure, the individual assumes personal ownership of the business’s assets and liabilities, with all business activities attributed to them directly. Consequently, the enterprise’s profits or losses are accounted for on the sole trader’s tax return. Sole traders are prevalent across various industries, encompassing professions ranging from freelance writers and consultants to artisans and proprietors of retail establishments.

Initial Setup for a Sole Trader

Establishing yourself as a sole trader necessitates meticulous attention to the initial setup process, laying the foundation for a successful venture. So, here is how to register as a sole trader.

A. Registering as a Sole Trader

It is essential to register as a sole trader with the appropriate government authorities before commencing business activities. The process generally involves obtaining a Unique Transaction Reference (UTR) and registering for the Valued Added Tax (VAT) if the business has a turnover of £85,000 or more. It can also be necessary to apply for certain licenses and permits, depending on the nature of the business and the industry, to comply with laws and regulations following authorities.

B. Setting up a Business Bank Account

While not legally obligatory, it is strongly recommended that sole traders open a separate bank account when you register as a sole trader. In addition to providing greater financial organization, this enables them to keep track of business income and expenses – crucial for sole trader tax purposes. It’s always wise to keep personal and business finances separate.

C. Understanding Sole Trader Tax Obligations

Tax obligations apply to sole traders and include income tax, VAT (if applicable), and potentially other taxes depending on the nature of the business. Any sole trader must understand and satisfy their tax responsibilities by calculating and remitting VAT, filing income tax returns, and keeping accurate records of all income and expenses. Penalties plus interest charges can result from a failure to comply with these tax obligations, so professional assistance normally should be sought to ensure compliance.

So, this is how to register as a sole trader. Now, let’s explore the benefits of professional accountants for sole traders.

Importance of Accountants for Sole Traders

A. Expertise in Tax Planning and Compliance

Experienced accountants have an intricate knowledge of sole trader tax regulations, codes, and accounting practices crafted to suit independent operators. Their knowledge and skills make them important consultants in advising how to limit taxes, ensuring adherence to relevant tax laws, and navigating the complexities of tax. By tapping the expertise of an accountant, sole proprietors can make the most of their tax circumstances without mistakes that can lead to fines or penalties.

B. Maximizing Deductions and Minimizing Tax Liabilities

Ensuring they are aware of any tax deductions is the ideal tax strategy for sole traders every year; therefore, contacting experienced accountants for sole traders can be a real game-changer.

They can advise on the applicable deductions for any given small business owner, which will lower their taxable income and their tax bill.

Apart from taxation advice, they can offer advisory services to lower operating costs, vehicle expenses, home office or telecommunication expenses, and depreciation of

assets.

C. Ensuring Accurate Tax Filings and Deadline Adherence

Engaging with a professional offers extensive benefits beyond simply meeting HMRC deadlines. Organizing tax returns and accompanying documentation can appear daunting for individuals new to business management, lacking a comprehensive understanding of tax and accounting regulations. Accountants for sole traders offer invaluable assistance by handling accurate tax return preparation and communication with HMRC, allowing entrepreneurs to focus on their core competencies: running their operations. This relieves them of the burden of balancing the risks associated with delaying filings due to concerns over paperwork or payment errors.

Sole Trade Taxation Made Easy with TaxCan Sole Trader Accountants

We at TaxCan are a team of experienced accountants for sole traders. We understand sole traders’ unique challenges and opportunities during their business journey. On top of meeting the special needs of sole proprietors, our experienced team of accountants offers comprehensive tax and financial services. And we can also help straighten out other financial wrinkles that bother them. Our expert advice on the Sole trader tax covers planning, compliance, and maximizing deductions, which keeps our clients in continuous compliance with tax laws and makes tax payments less bothersome.

Contact us today to register as a sole trader, or if you’re already a sole trader, we can

help you with financial management.

Wait There is More Here are Some Links

https://www.goselfemployed.co/guide-to-accountants-for-sole-traders

https://www.crunch.co.uk/knowledge/tax/a-guide-to-accountants-for-sole-traders

https://www.freeagent.com/guides/sole-trader/choosing-an-accountant